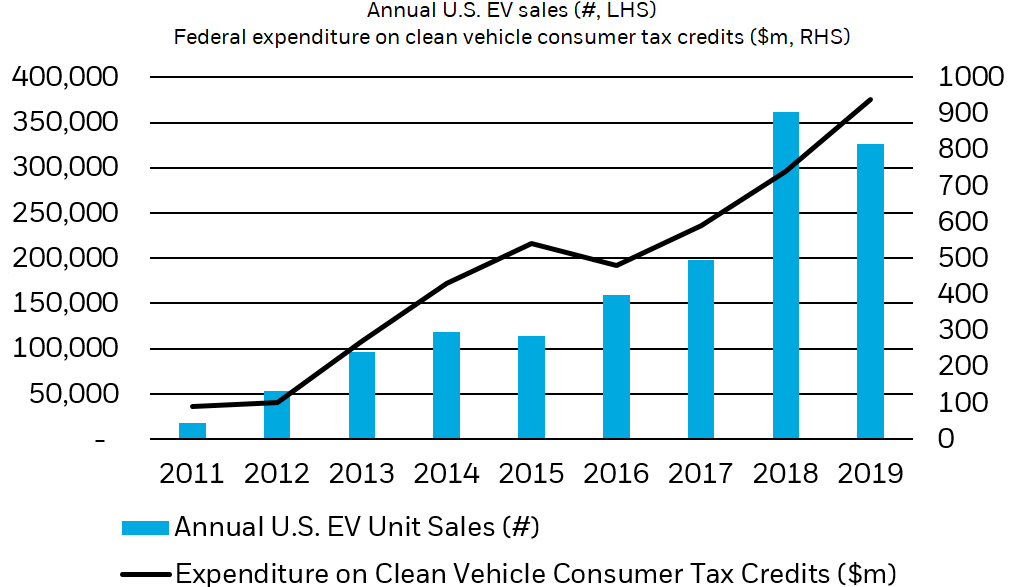

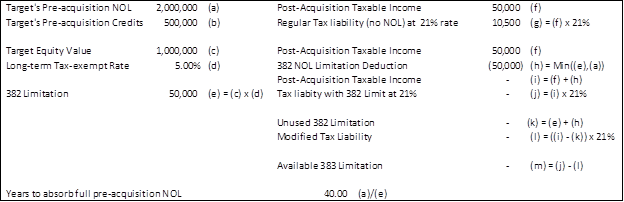

For the Record : Newsletter from Andersen : Q3 2019 Newsletter : Sweetening the Deal: The Value of Research Tax Credits in a Merger or Acquisition

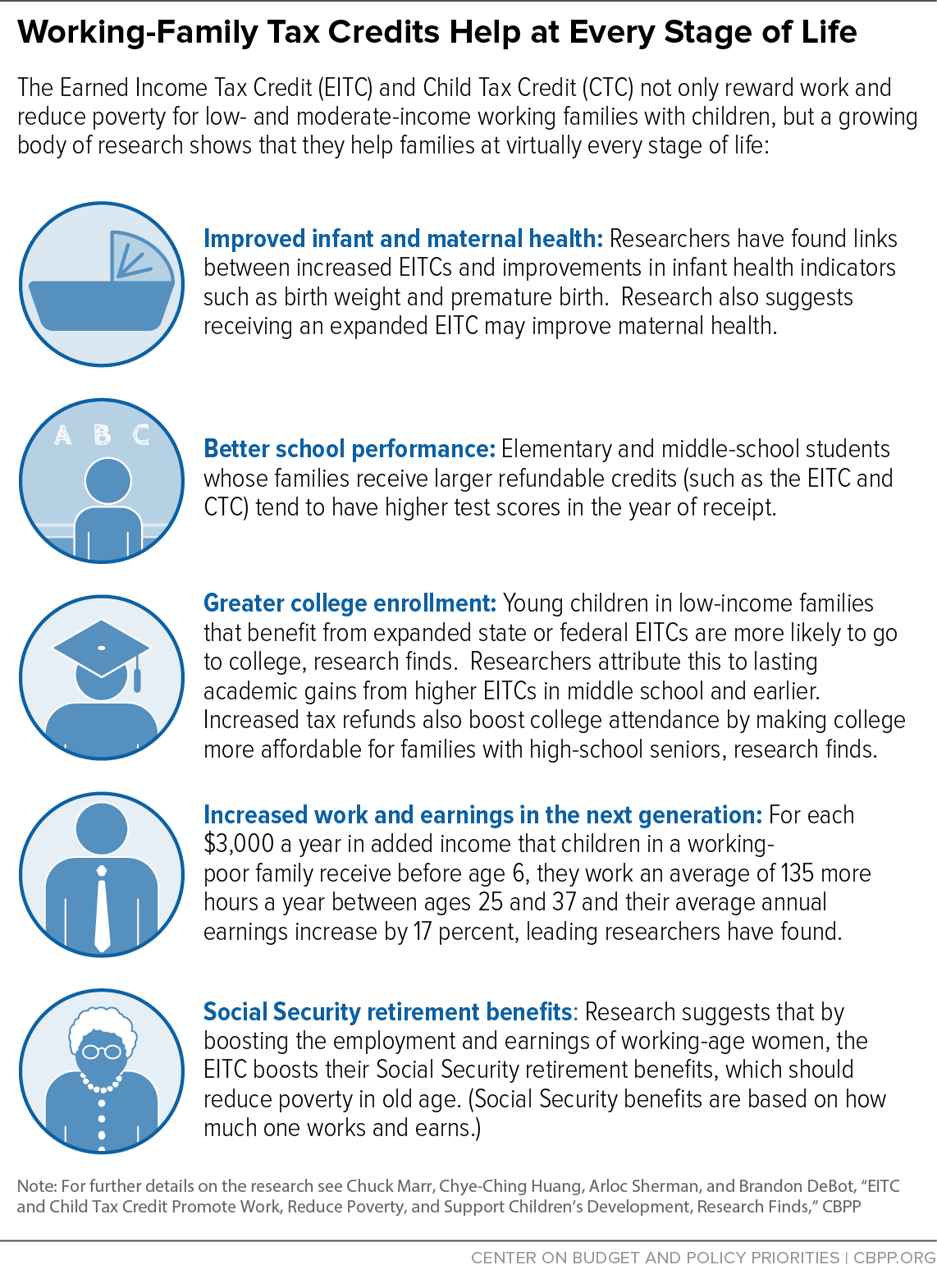

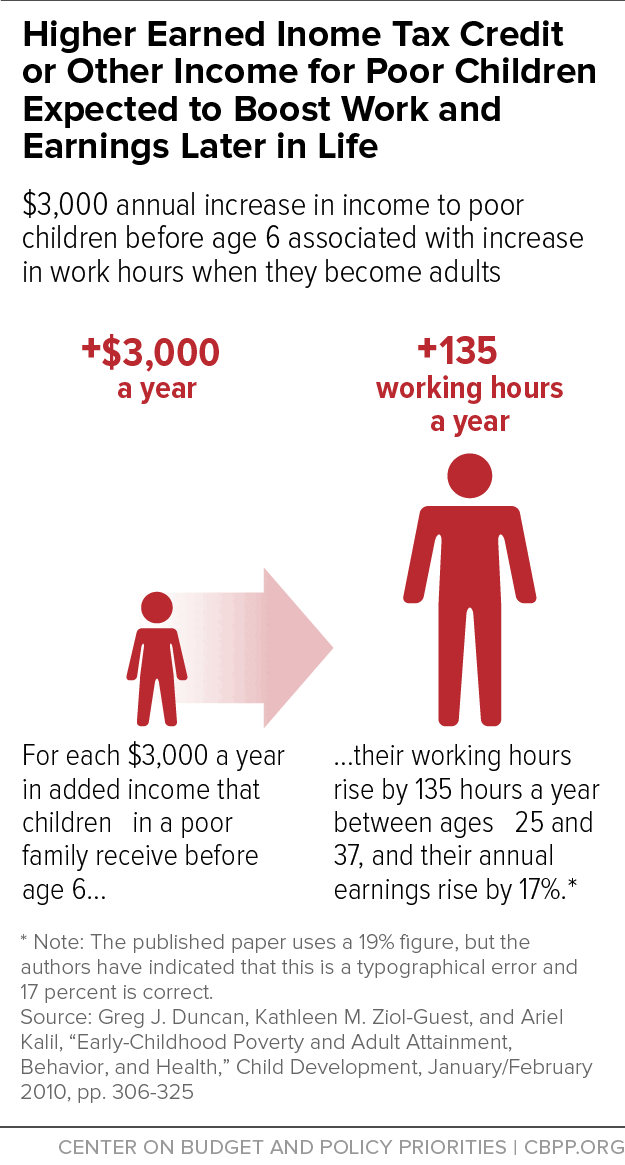

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

Why families claiming child tax credits face delayed tax refunds this year due to IRS law | The US Sun

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities